Mcgraw hill accounting exam 1 – Prepare for triumph with the McGraw-Hill Accounting Exam 1. This essential guide unlocks the secrets of the exam, empowering you with the knowledge and strategies to excel. Dive into the intricacies of accounting principles, master exam techniques, and conquer the challenges that lie ahead.

From exam structure to content coverage, this comprehensive resource provides a roadmap to success. Discover the key concepts tested, effective study strategies, and invaluable tips to maximize your performance. Get ready to ace the McGraw-Hill Accounting Exam 1 and embark on your accounting journey with confidence.

Exam Overview

The McGraw-Hill Accounting Exam 1 is designed to assess your understanding of fundamental accounting principles and concepts.

The exam consists of multiple-choice questions and is typically timed. The number of questions, time limit, and scoring system may vary depending on the specific exam you are taking.

Exam Format

The exam format typically includes:

- Multiple-choice questions: These questions present a scenario or question and provide several answer choices. You must select the best answer from the options provided.

- Time limit: The exam is usually timed, so it is important to manage your time wisely.

- Scoring system: The scoring system may vary depending on the exam, but typically each correct answer is worth a certain number of points.

Content Coverage: Mcgraw Hill Accounting Exam 1

The McGraw-Hill Accounting Exam 1 encompasses a wide range of fundamental accounting concepts and principles, assessing your understanding of the foundational aspects of accounting.

The exam is divided into multiple sections, each covering specific topics and s related to the core areas of accounting.

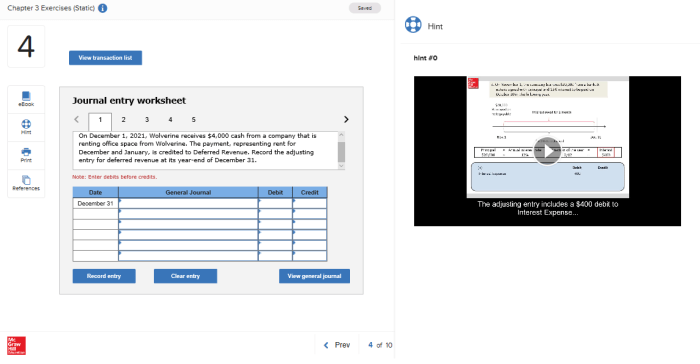

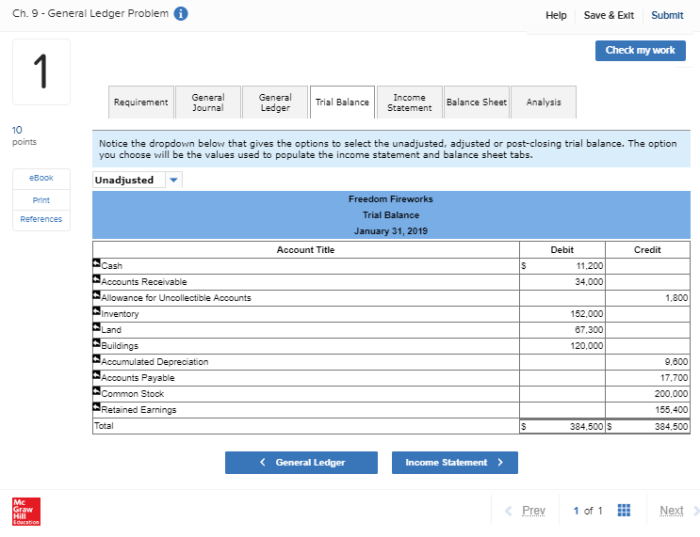

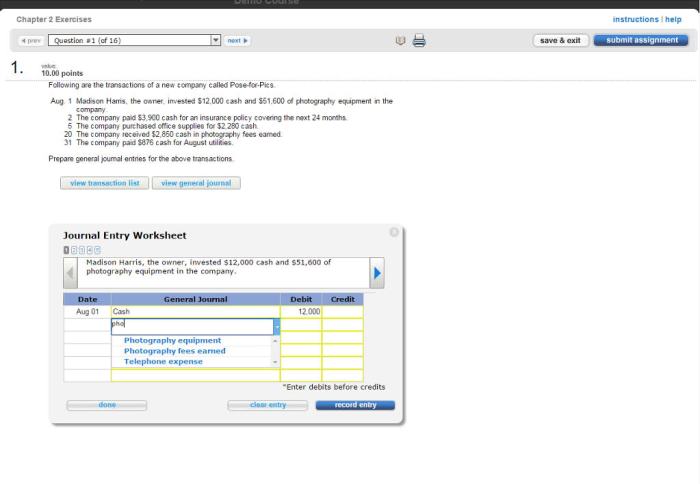

Financial Accounting and Reporting

- Basic accounting principles and concepts

- Preparation of financial statements (balance sheet, income statement, statement of cash flows)

- Analysis and interpretation of financial statements

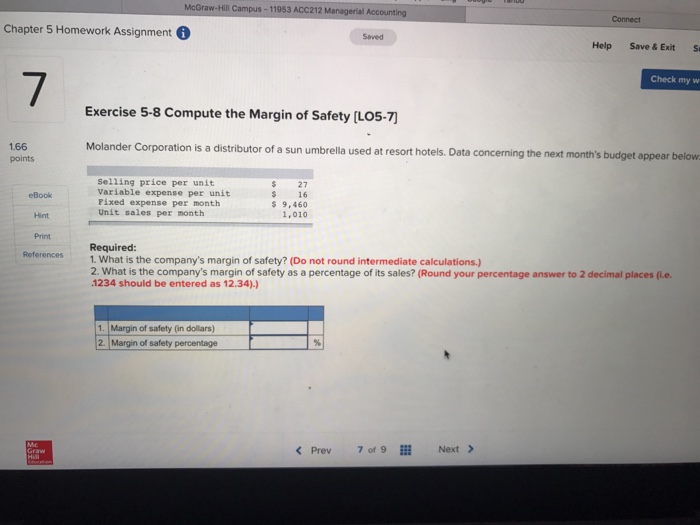

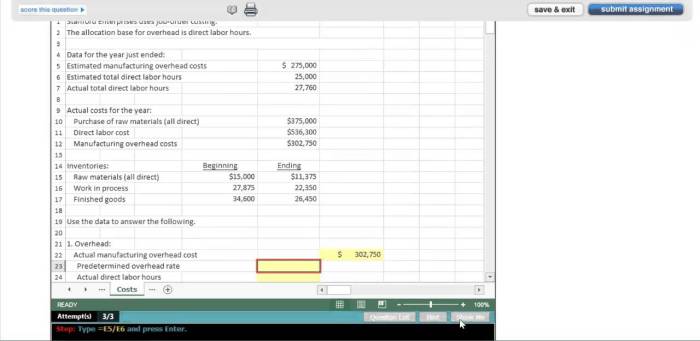

Managerial Accounting

- Cost accounting concepts and techniques

- Budgeting and forecasting

- Performance evaluation and decision-making

Auditing and Assurance Services

- Auditing standards and procedures

- Internal control and risk assessment

- Audit evidence and reporting

Taxation

- Federal income tax laws and regulations

- Tax planning and compliance

- Tax research and analysis

Exam Preparation

Preparing for the McGraw-Hill Accounting Exam 1 requires a well-structured approach. Effective study strategies and resources can significantly enhance your chances of success.

Recommended Textbooks and Materials

- McGraw-Hill Accounting: Principles

- Financial Accounting: IFRS Edition

- Online materials from McGraw-Hill Education

Practice Questions and Simulations

Practice questions and simulations are invaluable tools for exam preparation. They allow you to test your understanding of the concepts, identify areas needing improvement, and simulate the actual exam experience.

- McGraw-Hill Connect Practice Problems

- Exam Review Quizzes

- Case Studies and Simulations

Study Groups and Peer Collaboration, Mcgraw hill accounting exam 1

Study groups and peer collaboration can provide support, motivation, and diverse perspectives. Working with others can help you clarify concepts, share knowledge, and gain a deeper understanding of the material.

Tips and Techniques

Maximizing your performance on the McGraw-Hill Accounting Exam 1 requires strategic time management, effective question comprehension, and judicious answer selection. This section provides valuable tips to help you excel in these areas and minimize errors.

Time Management

Allocate your time wisely during the exam. Begin by scanning the entire exam to identify the length and complexity of each question. Prioritize answering questions you are confident in, and allocate more time to challenging questions later.

Question Comprehension

Read each question carefully and thoroughly. Identify key terms and concepts to ensure you understand what is being asked. If necessary, rephrase the question in your own words to clarify its meaning.

Answer Selection

Read all answer choices carefully before selecting one. Eliminate obviously incorrect answers first. If you are unsure between two or more options, consider the question context and logical reasoning to determine the most appropriate answer.

Challenging Questions

Don’t get discouraged by challenging questions. If you encounter a difficult question, skip it temporarily and return to it later. Focus on answering questions you are more confident in first, which will build your momentum and confidence.

Minimizing Errors

Carefully proofread your answers before submitting them. Check for any errors in calculations, grammar, or spelling. Avoid rushing or making assumptions, as this can lead to mistakes.

Example Questions

The following table presents sample questions from each section of the McGraw-Hill Accounting Exam 1. These questions are designed to demonstrate the range of question types you may encounter on the exam, including multiple-choice, true/false, and short-answer questions.

By reviewing these sample questions, you can gain a better understanding of the content covered on the exam and the types of questions you will be asked. This will help you prepare effectively and increase your chances of success.

Multiple-Choice Questions

Multiple-choice questions present you with a question or statement followed by several possible answers. You must choose the answer that you believe is correct.

Ace your McGraw-Hill Accounting Exam 1 with confidence! Take a break from studying and indulge in the entertaining world of crosswords. Check out the all sales are final crossword to sharpen your problem-solving skills. Return refreshed and ready to tackle your exam with renewed vigor!

- Which of the following is NOT an element of financial statements?

- Assets

- Liabilities

- Income

- Owners’ equity

- Expenses

True/False Questions

True/false questions present you with a statement and ask you to indicate whether the statement is true or false.

- The accounting equation is Assets = Liabilities + Owners’ Equity.

- Debit balances increase assets and decrease liabilities.

Short-Answer Questions

Short-answer questions require you to provide a brief written answer to a question or prompt.

- Define the term “asset.”

- Explain the difference between a debit and a credit.

Additional Resources

This section provides access to valuable resources that can supplement your exam preparation journey. These resources range from informative websites to supportive online communities, all designed to enhance your understanding of the exam content and strategies.

Helpful Websites

-

-*McGraw-Hill Education Accounting Exam 1 Website

This official website offers comprehensive information about the exam, including its structure, content coverage, and registration details. It also provides practice questions and sample tests to help you gauge your readiness.

-*AccountingCoach

This website features a wealth of accounting resources, including tutorials, articles, and videos covering a wide range of accounting topics. It’s an excellent resource for reinforcing your understanding of the exam concepts.

Online Forums and Support Groups

-

-*Accounting Discussion Forums

These online forums provide a platform for students to connect with each other and discuss exam-related questions, share study tips, and offer encouragement. They can be a valuable source of support and insights.

-*Study Groups

Joining a study group can provide a structured and collaborative environment for exam preparation. It allows you to engage with peers, share knowledge, and hold each other accountable for progress.

Exam Administrator Contact Information

For any questions or concerns regarding the exam administration, you can contact the relevant authorities using the following information:

-

-*Exam Administrator

[Name of Exam Administrator]

-*Contact Email

[Email Address]

-*Phone Number

[Phone Number]

By utilizing these additional resources, you can maximize your exam preparation efforts and increase your chances of success on McGraw-Hill Accounting Exam 1.

FAQ Guide

What is the format of the McGraw-Hill Accounting Exam 1?

The exam consists of multiple-choice, true/false, and short-answer questions covering various accounting topics.

How much time is allotted for the exam?

You will have a limited time to complete the exam, so time management is crucial.

What are the key accounting concepts tested on the exam?

The exam focuses on fundamental accounting principles, including financial reporting, accounting cycles, and internal controls.